Are you suffering from a financial crisis and seeking ways to recover? No worries if you do because you aren’t alone. Millions of Europeans are swamped into financial hardship and sometimes need to seek credit online to manage their monthly expenditures.

So, how do you recover from a serious financial setback? What strategies can help you manage these challenges and get you back on your feet? Keep reading to learn the vital shortcuts to financial prosperity.

Accept Your Situation

Accepting your financial situation is the first step to recovery. Irrespective of its cause, you must admit that you have a problem. Further, you have to be positive about the situation and believe that there is a way out of it.

Whether you caused the crisis or you are an innocent victim of someone else’s irresponsibility and malice, living in denial won’t solve the issue. Moreover, focusing on your prosperous past will do nothing or little to help you overcome your crisis.

Audit Your Assets

After accepting your current economic situation, audit your finances and property to see what you have. An accurate estimation of your assets is vital before taking any measures to get what you need in the future. This inventory helps you benefit from the principle of using what you have to get what you need.

Also, assess the liabilities the crisis has plunged you into. For instance, have you incurred debts because of the crisis? If you have, how do you intend to repay your debts? Locating where you are regarding assets and liabilities will help you create a realistic recovery roadmap.

Common assessment questions to ask yourself include the following:

How many assets do you have?

How many debts do you have, and whgat is the repayment schedule?

What is your monthly income?

What is your monthly expenditure?

What is your credit score?

Define the Crisis and Identify Its Cause

Now that you have accepted and assessed your financial situation, it’s time to define its causes. You need this step because being in debt alone doesn’t mean you are in a crisis. Some debts are unavoidable, and the only way average citizens can get some valuable assets in life is a mortgage or long-term credit. Thus, borrowing within your means to invest or buy a house isn’t a crisis.

Yet, being in a chronic and deepening debt is indeed a crisis, and you should understand how you have got into such a situation. Did your poor “financial hygiene” cause your financial problems? Did you land into this ditch because you tried living beyond your means? If your lifestyle or mindset is to blame, then you’ll need a different approach to money in the future.

Below are red flags that indicate you are in a financial crisis:

You can’t pay your bills without borrowing.

You have several credit cards, and sometimes you use one to pay for another.

You are refinancing your home to support your lifestyle or pay debts.

You can’t pay more than the minimum amount required on your credit cards.

You delay payments.

You spend over 40% of your gross income to repay debts.

Your financial situation is stressing you.

Cut Unnecessary Costs

Cutting off unnecessary expenses is another strategy to rise out of a financial crisis. This step is possible when you review your budget to identify areas where you can minimize or eliminate some expenses. These expenses can be club membership, cable TV subscriptions, or outdoor entertainment.

Learn and Improve

You can also overcome a financial crisis by learning and improving. These practices will enable you to examine and reflect on your financial experience or performance for the last five years. As a result, you will identify the best lessons and areas for improvement.

When adjusting your lifestyle and approach, you should also monitor the results of your recovery strategies. Try out different tactics as time moves on until you have fully recovered.

Increase Your Income

Growing your disposable income is a great way to come out of your crisis faster. It will also reduce your financial burden as you pay your debts so that you don’t sink below the minimum levels. Some ways to boost your earnings are as follows.

If you are employed, ask your employer if they can allow you to work overtime.

Sell personal items that you no longer need or use.

If you are a student, you can find a roommate.

If it’s possible, get a second job.

Monetize your hobbies and passions by turning them into side hustles.

Use Your Emergency Fund

Creating an emergency fund can hedge you against financial difficulties. You can have one that can carry you through three to six months. Having this fund saves you the temptation to borrow to pay your monthly bills. This fund can be a good starting point that cushions you while working on your recovery strategies.

Consult Your Financial Advisor

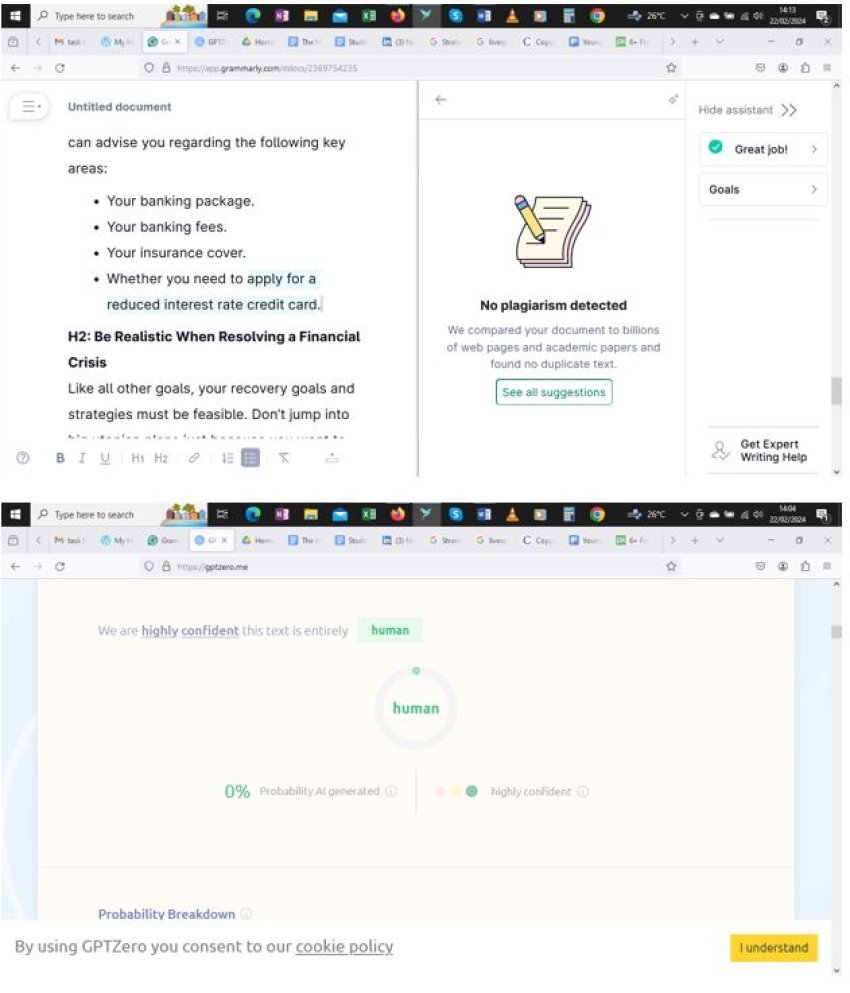

Don’t suffer alone when facing a financial crisis. You can talk to a financial advisor to help you recover lost ground. The consultant can advise you regarding the following key areas:

Your banking package.

Your banking fees.

Your insurance policy.

Your ability to apply for a credit card with a reduced interest rate or annual fees.

Be Realistic When Resolving a Financial Crisis

Like all other goals, your recovery goals and strategies must be feasible. Don’t jump into big utopian plans just because you want to recover fast. Otherwise, unrealistic goals will kill your morale. For instance, if your financial indiscipline landed you in debt after many years, it’s very unlikely you will repay those debts within a few months unless you win a lottery.

Care for Your Physical, Mental, and Emotional Health

Lastly, care for your health—soul and body—because financial challenges can be really stressful. This stress may directly affect your physical health and even cause you to slide into depression. Your bodily and psychological health is critical to boosting your recovery. Otherwise, you’ll only punch another hole in your finances by incurring avoidable medical expenses.

Closing Remarks

Anyone can land in a financial crisis and recover from it. With proper strategies, you can regain your former financial well-being and enjoy prosperity again. Twy some of these tactics today to start a successful recovery journey.